The recent drama surrounding Renzo has underscored a broader limitation that we are slowly but surely encountering with oracles: the lack of modularity. By "the Renzo drama," I am referring to the depeg part, not the tokenomics one, although they are connected. So let's delve into the pricing of assets because that is what this is all about. But before we do that, we should understand how oracles currently price any asset and why they do so. For this, we need to go back to Ethlend, which was the first peer-to-pool lending protocol on Ethereum. It later rebranded to Aave and shifted its model to a peer-to-pool one, highlighting the complexity for end users in managing positions alone in a peer-to-peer model, with many parameters, and without the knowledge required. This model change drove adoption due to its simplicity for the end user, and the infrastructure enabling it was the oracle. The oracle's role was to report the price of short-tail assets in the safest manner, avoiding manipulation, and guaranteeing liveness. This is when the current model was introduced: a set of nodes reports prices across different markets (on and off-chain), and a price is constructed using either a median or a VWAP.

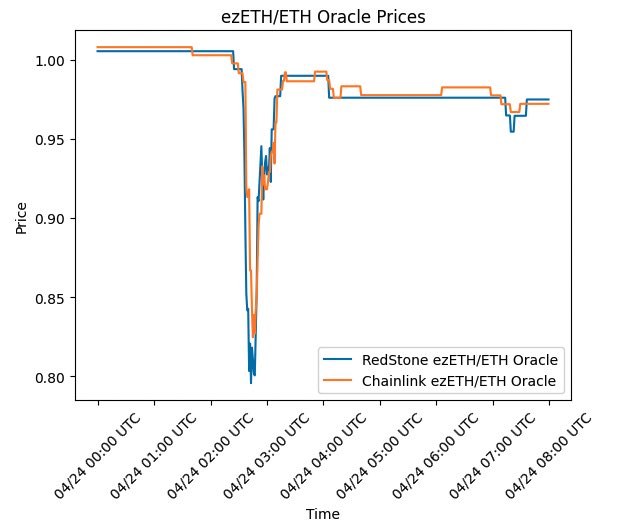

It worked pretty well — for short-tail assets, at least — for the reason that a VWAP is arguably the best pricing solution for this kind of asset, even if some new pricing methods are emerging. But crypto is maturing, and more assets are now available for trade, and new instruments are being created: LSTs, LRTs, stablecoins, options, perps, etc. Does it mean that we should continue using the same method to price them with a VWAP? Definitely not. Let's consider a few examples, starting with the Renzo incident. Here are the prices reported by Chainlink and Redstone for ezETH during the depeg:

Source: https://twitter.com/inkymaze/status/1783075969940574496

We can observe a very similar behaviour stemming from the same pricing method: a VWAP. During this crash, was Renzo insolvent or illiquid? The answer is the latter; the available liquidity was too thin to support people exiting, but it doesn't mean that the asset became undercollateralized. For this kind of asset, VWAP pricing just isn't the right tool.

Let's delve further into another example: the MakerDAO/Morpho/Ethena combination. Maker allocated part of their balance sheet to loans backed by Ethena USDe and sUSDe collateral, using Morpho with a fixed price oracle. This means that USDe is hardcoded to $1 on the Morpho pool. To understand the trade-offs, I encourage you to read this great blog post by Sebastien Derivaux. Is the fixed price better than a VWAP in this case? Probably. Is it the best solution? Probably not.

There are dozens, if not more, cases like this where the VWAP just isn't the right tool to price the assets. I've listed multiple examples but haven't answered the question of what the best pricing model is for each of these assets. And while I may have a personal opinion, the real answer is that my opinion doesn't matter. The way an instrument or an asset is priced is a choice made by a protocol and will become a main differentiator for them. The reason why it's not the case now is that it's just not possible yet — every oracle usable on the market is a monolithic infrastructure, trying to fit the same model to every use case created. If we get the ability to change the model with the same (or fewer) trust assumptions, not only will we get a thousand use cases that weren't even possible before, but we will also have the greatest efficiency improvement in DeFi to date (and probably in other verticals too).

This is what we're building at Pragma. If you're a financial engineer working on the pricing of assets in crypto, or anyone who wants to join our mission, please reach out at careers@pragma.build.